Investors often think of their real estate exposure in terms of property type and geography, but there are many other potential factors that may help explain performance.

Our analysis shows lease length has historically been one such cyclical factor, with long leases having provided a performance boost during periods of weakening rental growth – an insight that may prove particularly relevant in today’s economic environment.

Investors may wish to benchmark more than just property type and sector exposure.

In 1956, California’s Van Nuys News proclaimed the three most important things about real estate to be location, location, location.1 In the 64 years since, asset-specific risk and high-level macro issues have become increasingly important considerations, as have understanding what drives risk and return in this complex and diverse asset class and how it correlates with others.

Fast-improving technology and the evolution of big data have meant that a higher volume of information can be processed more efficiently in helping investors understand risk and return drivers and aid portfolio construction. Lease structures and the quality of tenants have often been among the key drivers of growth and resilience of cash flows. This blog investigates the impact lease length has had on relative investment performance in both rising and declining markets. The ongoing global spread and negative impact of the novel coronavirus may be an example of a scenario where the significance of lease lengths could come to the fore.

Real estate investors’ white WALE?

Historically, past performance in real estate has primarily been explained in terms of property type and geographic exposure. But there are many other potential factors that can help explain real estate performance. Our analysis found that lease length has been one such cyclical factor.

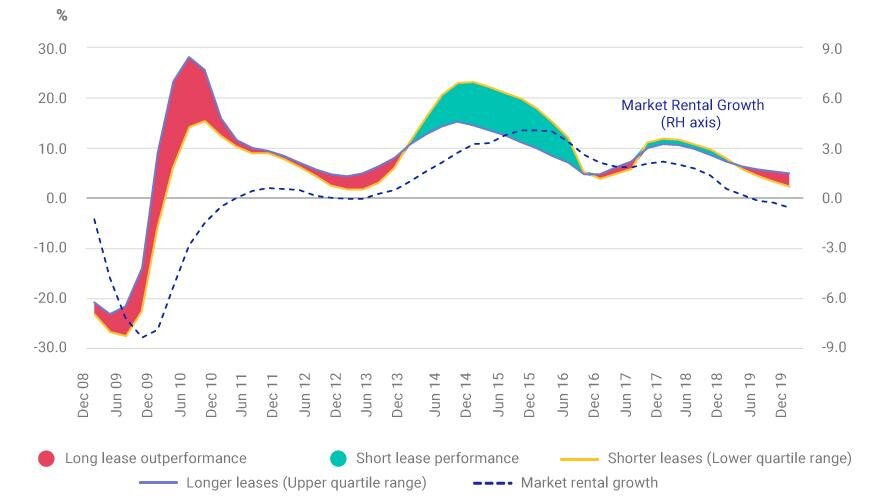

The exhibit below shows the annual total return of the MSCI UK Quarterly Property Index segmented by remaining lease term. For the purposes of the analysis, shorter- and longer-lease properties are defined as those with a remaining lease term in the bottom and top quartiles per period, respectively.

Looking back to 2008, longer-lease real estate assets provided a performance boost during declining market periods, since properties with a longer weighted-average lease expiry (WALE) were likely to be more insulated from negative reversionary potential. On the flipside, longer-lease assets depressed returns during rising markets, as properties with a drawn-out expiration profile were less able to capture reversionary upside through active management intervention, compared to properties with a shorter WALE.

In the five-year period after the global financial crisis, long-lease properties in the U.K. delivered an annualized total return of 9.6%, compared to the 5.2% of shorter-lease properties. By contrast, in the period from the first quarter of 2014 to the second quarter of 2016, shorter-lease assets stole the limelight, courtesy of buoyant growth in market rentals. This came as the U.K. economy grew at its fastest rate for nine years in 2014. From the second quarter 2016 to fourth quarter 2019, longer-lease assets provided an extra 100 basis points (bps) in annual returns, aided by their reduced exposure to dilutionary lease events. Rental growth and returns were already weakening ahead of the coronavirus outbreak in the U.K., with longer leases beginning to outperform. We may see this trend accelerate as the pandemic begins to impact rental income (refer to chart below).

Longer leases were a boost during weakening markets but a drag during rising markets

Lease length improved sector returns

After the U.K. Brexit referendum, industrial property in the U.K. has had a strong run, delivering an annualized total return of 13.2% from June 2016 to December 2019, compared to the retail property sector’s -0.3%.2 However, retail properties with actively managed lease lengths, the outcome would likely have been more favorable. Over the same analysis period, long-lease retail property delivered an annualized total return of 5.3%, 380 bps in excess of the 1.5% annual return of shorter-lease retail assets, as its exposure to negative rental reversions would have been more contained. By contrast, shorter-lease industrial assets, with an annualized total return of 14.9%, outperformed longer-lease industrial property, which produced an 11.3% annualized return, based on the latter’s higher exposure to accelerating market-rental growth.

The exhibit below shows the decomposition of the relative capital growth of long versus short leases for the retail and industrial sectors, annualized over various time periods. In more recent periods, much of the respective outperformance of shorter-leased industrial and longer-leased retail property was due to superior fundamental income growth as opposed to yield-compression-driven capital growth. This suggests that the relative exposure to potential rental reversion may have been the more significant driver of relative performance during the analysis period.

Income growth mattered most

Assessing performance from all angles

With real estate now occupying a greater slice of multi-asset-class portfolios, investors have been looking beyond inherent property attributes such as sector and location as the key drivers of investment performance. In the same way that factor analysis has helped explain more systematic drivers of performance in the broader equities market, a similar analysis might be made of real estate assets. Factors such as lease length, which were previously perceived to have been attributed to idiosyncratic risk and stock selection, may be more systematic drivers of return than previously thought.

There has always been a need to understand the drivers of risk and return in investment portfolios; but as investors face an increasingly uncertain COVID-19-impacted world, the more factors we can analyze to understand performance and help position portfolios, the better.

Source: MSCI