European legacy loan de-leveraging is forecast to smash 2015’s record annual disposals of almost €105bn with sales to top €130bn this year, in a punchy prediction by Deloitte as part of its comprehensive market review and outlook.

Deloitte has identified €44.5bn live and pending loan portfolio sales across 51 deals, which reflects approximately one-third of its bumper 2016 prediction, the vast majority of which it expects to see close this year.

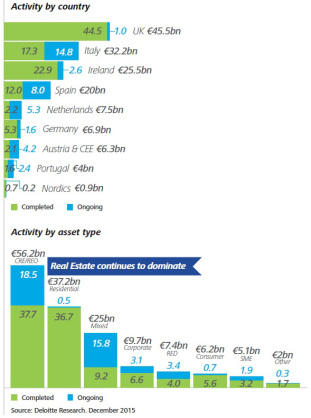

This pipeline – which includes two mega UK residential loan portfolio sales by UKAR together totalling £24bn – is expected to be supported by increased sales in Italy, Spain, the Netherlands, Ireland, Central and Eastern Europe (CEE) and South Eastern Europe (SEE).

The advisory firm says government and privately-owned institutions throughout these jurisdictions will be looking to capitalise on investor sentiment and a general improvement in European real estate markets.

Italy was singled out by Deloitte as having dramatically stepped up its pace of de-leveraging. Following completed sales of €17.3bn in 2015, there remains €14.8bn in ongoing deals which Deloitte predicts could rise to €25bn in closed 2016 deals.

Elsewhere, the Netherlands is tipped for an active first half of the year, which is expected to be led by Propertize’s €5.5bn Project Swan corporate sale.

David Edmonds, global head of Deloitte’s portfolio lead advisory services, said: “We expect the increasing trend of deleveraging from European financial institutions to continue as they tackle over €2trn of non-core and non-performing assets.

“Increased regulation and capital requirements for banks and insurance companies as a result of Basel III, Solvency II and in the future IFRS9 continue to stimulate divestitures.

“Regulatory pressures aside, the market are forcing the financial sector to accelerate the retreat to home markets and place a stricter focus on core businesses and strategic direction. This will undoubtedly drive higher levels of activity in the market.

“Whilst buyer appetite remains strong, the supply of price-accretive loan-on-loan financing for large scale deals may prove challenging. We expect buyers with strong track records and deep relationships with funders will continue to lead the way in acquisitions.

“Certain markets are becoming more mature with some sellers now focusing on divesting their performing non-core assets; however we still believe that certain distressed situations in key European markets have yet to be unlocked.”

Those unlocked markets include Greece, which Deloitte expects to emerge as a buoyant NPL market over the coming years, conservatively estimating that as much as €29bn in transactions could close between 2017 and 2019.

According to Deloitte, in its annual Deleveraging Europe report for 2015 and 2016, €104.3bn of European non-core loans were traded across 123 completed deals in 2015, reflecting a 25.8% increase on 2014’s €82.9bn.

The majority of this €104.3bn figure comprise loans secured by commercial real estate (CRE) and residential, at €37.7bn (or 36.1%) and €36.7bn (or 35.2%), respectively. Together, CRE and residential loan sales in Europe accounted for €74.4bn (or 71.3%) of total loan portfolio sales tracked by Deloitte.

In addition, a further €6.6bn of corporate loans, €4.0bn of real estate development loans, €5.6bn of consumer loans, €3.2bn of SME loans and €9.2bn in mixed loan portfolios were sold last year. Another €1.7bn of loans additionally categorised as ‘other’ loans were also recorded.

Non-real estate linked loan portfolio sales within Deloitte’s €104.3bn total looks to be limited to just the consumer loan sales and a proportion of the SME and ‘other’ buckets, amounting to approximately €8bn to €10bn of the total.

Cerberus Capital Management was the runaway largest investor in Europe’s loan sales market last year, purchasing €32.4bn in non-performing and performing loans – more than four-fold increase on the second most active investor, Deutsche Bank, which acquired €7.8bn in loan portfolios.

Goldman Sachs, CarVal Investors and Lone Star complete the top five investors, acquiring €5.8bn, €5.5bn and €5.4bn, respectively, according to Deloitte.

The five largest buyers together acquired €56.9bn in European loan portfolios, reflecting 54.5% of all sales.

The top five vendors – bad banks and institutions exiting the real estate lending sector – together sold €52.6bn of loans which reflects half of the entire market last year. UKAR sold €17.9bn, GE Capital sold €12.9bn, NAMA sold €11.3bn, Permanent sold €5.5bn and Ulster Bank sold €5.0bn.

By country, €44.5bn of completed deals in 2015 came from the UK; followed by Ireland, with €22.9bn; then fast-climbing Italy with €17.3bn. Spain’s €12.0bn of completed deals and Germany’s €5.3bn complete the top five most active countries for loan sales, according.

Source: Deloitte